This is the first article in a 5-part series about automotive storage. In this piece we take a look at the ways automotive architecture is evolving and how that evolution is affecting today’s data storage solutions.

We all know that automotive electronics are facing unprecedented changes—from the evolution of new energy and autonomous driving technologies, upgrades to in-cabin entertainment systems, streaming entertainment, connectivity, software-defined cars, fleet management and changes in all terminal requirements.

These changes are having a significant impact on the underlying electronic and electrical architecture of automobiles. Such challenges have prompted the automotive industry and semiconductor industry to engage in unprecedented levels of collaboration.

Huge amounts of data flow in and across modern vehicles

Over the years, autonomous driving systems have increasingly adopted camera, ultrasonic, LiDAR and radar technologies, these sensors are used to detect the environment of the car, which have brought large amounts of data to the “edge”. This raw data needs to be processed to provide precise driving decisions for vehicles. Today’s cars also enable real-time interaction between infotainment systems and these sensors, such as rearview image display, e-mirrors, surround-view, and driver monitoring systems. And autonomous driving assistance systems (ADAS) are increasingly freeing up driver and passenger time and attention.

All of these advanced capabilities are resulting in more focus on cockpit experience, such as Tesla providing the ability for passengers to play AAA games on its central entertainment system. These developments are also driving a significant increase in the volume of data transmission within the vehicle, the number of electronic control units (ECUs), computing power and (of course) storage demand.

The rising cost of integrating numerous components and heavy verification work on more ECUs has forced car manufacturers and Tier 1 suppliers to consider how to re-design the electronic/electrical (E/E) architecture for modern vehicles. (Exhibit 1)

Figure 1: The modern cars are generating massive data, driving a shift in their architecture

Future storage demand in automotive electronic architecture

While automotive semiconductors are one of the most important driving forces in the growth of the future semiconductor market, people often wonder, “What about NAND flash storage?” Industry experts estimated that the automotive NAND flash market will grow to $5 billion by 2028, up from $2 billion in 2023, but many people are skeptical because they wonder what the enormous opportunities are that will cause such explosive growth. The answer is actually implied in the first paragraph of our article, which are the various applications of intelligent vehicles. However, in order to provide a more professional and detailed response to this question, we further dissect the electronic/electrical (E/E) architecture of automobiles.

Let’s take a closer look at the details.

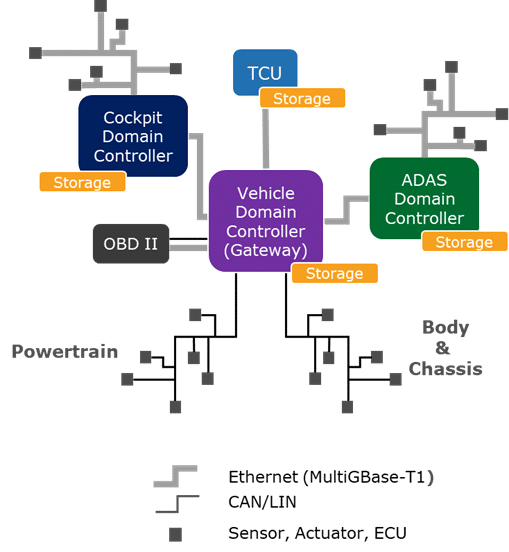

The E/E architecture of automotive is extremely complex and can take three to five years from design to verification to mass production. It can vary from one company to another, but in the past 5 years, more and more designs have moved towards domain-centralized architecture. (Exhibit 2)

Figure 2: Storage demand in a domain-centralized automotive architecture.

Domain-centralized architecture integrates numerous ECUs into a single domain controller. Each domain controller is responsible for specific functions in the vehicle, such as autonomous driving, cockpit entertainment, or power and chassis control. This helps reduce wiring harnesses, simplifies verification complexity, supply chain management, saves on costs, and frees up space and weight.

The most significant impact on in-vehicle NAND storage is the increased demand for higher-capacity, better reliability, faster and more easily integrated than traditional data storage has been.

As we know, the NAND flash in storage devices have evolved from small-capacity SLC and MLC solutions to 3D TLC. The management of NAND flash by the controller has become increasingly complex. In particular, the ability for error correction needs to be further improved to ensure the reliability of storage devices. Here, the algorithm design of controller and verification experience are especially important. We will discuss this in more detail in future articles. For now, let’s further explore the requirements and applications of storage devices for automotive systems.

For those who are skeptical about the future opportunities of automotive NAND storage, should consider the following facts: A single vehicle currently requires three to five storage devices. Assuming there are 80 million car sold annually, the volume of automotive NAND storage devices sold could eventually exceed the annual shipments of SSD in laptops. Although there is still a significant gap in capacity requirements between the two, the transition of the architecture and the growth in intelligent applications will also take place over several years, this is still undoubtedly an enormous opportunity for NAND flash storage in the future.

In-depth analysis of applications for automotive storage

The NAND flash storage devices in vehicles are used for various system. We categorize them into four main categories based on their applications.

Telematics control unit (TCU, T-Box)

Telematics is the integration of two sciences: telecommunications and informatics. A vehicle’s telematics system is the central hub for nearly everything that wirelessly connects to the car. It enables over-the-air (OTA) updates, rapid remote response to incidents with technologies such as eCALL, fleet management and remote diagnostics.

When telematics systems are integrated with 5G, vehicles can communicate with roadside units (RSUs) as well as other vehicles, pedestrians and drivers. This communication ability is known as V2X, which stands for Vehicle-to-Everything. We believe this is how the future connected car will be enabled, Additionally, with better control over the environment and other connected objects, it will further enhance the reliability and functionality of ADAS.

Global TCU shipments exceed 50 million units per year. As for the storage demand of these systems, they generally require relatively small storage capacity so eMMC with less than 16 GB is typical here.

Cockpit domain controller (CDC)

Many people struggle to differentiate between the terms CDC and traditional in-vehicle infotainment (IVI). In fact, CDC is a subsystem under the domain-centralized architecture. By definition, its hardware system must integrate all the information and entertainment functions inside the cockpit, including the instrument cluster, heads-up display (HUD), voice recognition, rear-seat entertainment and central infotainment system—while also being offering compatibility with multiple virtual machines and operating systems.

Currently, fewer than 15% of vehicles in production have CDC systems. However, when CDC and traditional IVI systems are combined under the infotainment domain, they are actually the largest application in the entire automotive storage market, accounting for more than 80% of automotive NAND bit demand. CDC systems can use eMMC, UFS or PCIe SSDs in capacities from 16 to 256 GB, depending on the level of the vehicle and the richness of the applications being implemented.

Advanced driver assistance system domain controller (ADC)

The technologies involved in advanced driver assistance systems cover safety, regulations, driver acceptance and other issues, rendering its development steady rather than explosive. However, this is currently the most discussed technology and an irreversible megatrend in the automotive industry.

For now, eMMC is still the mainstream storage requirement for these domain controllers. Still, with the rise of data transmission rates, many designs have also been based on UFS storage solutions. Looking into the future, with the development of this technology, ADC systems should be the highest-growing area for automotive NAND storage demand in the coming years.

Central gateway

The central gateway serves as the data interchange hub for the vehicle network. It converts various communication protocols within the vehicle (such as LIN, CAN, FlexRay, Ethernet, etc.) and routes data between different functional domains. It provides physical isolation and also fulfills the network security functions of the vehicle.

The applications include event data recorder(EDR), diagnostic routing systems, fleet management, cybersecurity management and OTA update management. Sometimes, it even incorporates the functions of the body domain controller. Generally, eMMC is the mainstream storage solution here, but high-capacity PCIe SSDs are often used for fleet management in commercial vehicles.

Phison – the leading provider of automotive storage

As automotive technology evolves to rely more heavily on data than ever before, Tier 1 suppliers and OEMs have deployed domain-centralized architecture. The applications supported by this architecture demand larger, faster, and more reliable data storage solutions. This field is expected to experience incredible growth in the near future

That is why Phison Electronics continues to make significant investments in the research and development of automotive storage solutions. As the world’s largest supplier of automotive eMMC controller IC, Phison not only obtained automotive functional safety development process certification, ISO 26262, but also became the world’s first independent NAND flash controller supplier to earn Automotive SPICE (ASPICE) CL3 certification.The company has been engaged in technical and business collaborations with leading NAND flash manufacturers and automotive industry partners to ensure its leadership position in the automotive storage market.

Now that we’ve explored how evolution of automotive technology is driving demand for storage solutions, our next article will take a look at how interface is transitioning from eMMC to UFS, and even future PCIe BGA SSDs. Don’t miss out on our second article in the automotive storage series.