Vehicles are becoming smarter, cleaner, and more connected, and semiconductors are the critical technology behind automotive industry’s next evolution.

In 2016, GM’s President Dan Ammann famously stated, ”We see more change in the next 5 years than there’s been in the last 50.” And five years later, the quote certainly seems to be true.

Traditionally, OEMs have created value through engine performance, quality of materials, and driving comfort. But today, most are reinventing themselves by developing autonomous driving features, electrification, in-vehicle experiences, and smart connectivity. Most automotive innovation is now electronic, not mechanical – and the rules of the game have changed forever.

ACES and semiconductors

Automaker Daimler coined the acronym ACES as part of its corporate strategy, which stands for Autonomous, Connected, Electric, and Shared (Figure 1). A, C, and E represent technical challenges, while S refers to changing value chains and revenue streams. Now a common term, ACES defines the four mega-trends driving the transition towards new mobility. According to McKinsey, investors have poured nearly $330 billion into 2,000+ ACES-focused companies between 2010 and 2020.

Autonomous Vehicles: The future of autonomous driving

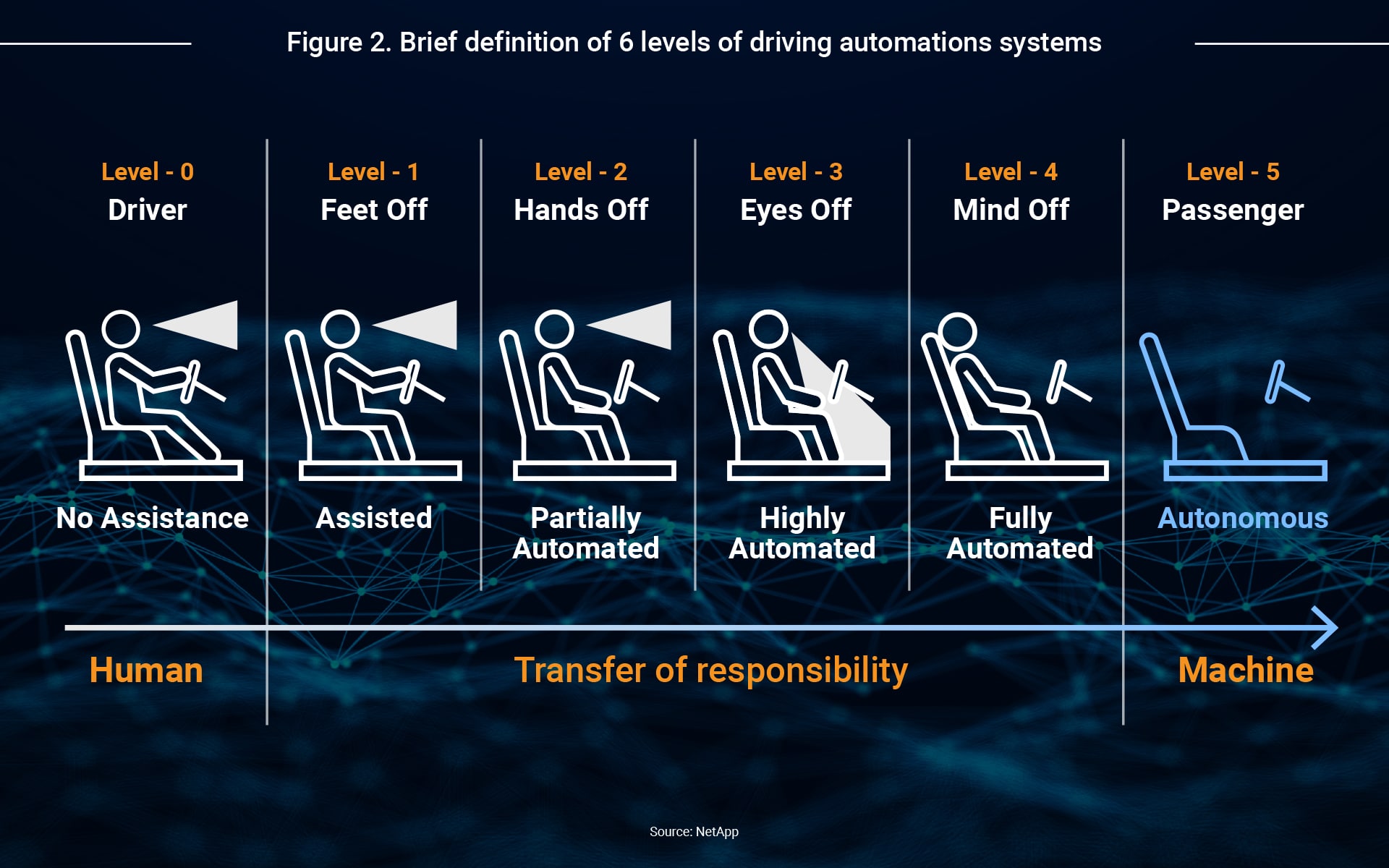

The Society of Automotive Engineers (SAE) defines six levels of driving automation, ranging from Level 0 (fully manual) to Level 5 (fully autonomous) (Figure 2). Today’s cars sit between levels 0 and 2, but a growing number of OEMs, Tier-1s, software companies, and semiconductor industry giants are collaborating to enhance autonomous driving technology.

Advanced Driver Assistant Systems (ADAS) are the key to higher-level autonomous driving, in which advanced sensors combine with high-performance computers via these three steps:

- Data input: Ultrasound sensors, cameras, radars, LIDAR, infrared sensors, and HD Maps provide environmental information.

- Sensor fusion + decision making: SoC devices with complex algorithms and machine learning systems use data from various sensors to make decisions.

- Vehicle control: The automated system sends instructions to the vehicle’s actuators which control functions such as acceleration, braking, and steering.

Increasingly, ADAS development requires semiconductor expertise in high-speed processors, memory, NAND flash storage solutions, AI, and machine learning. Gartner and Deloitte estimate the ADAS semiconductor market will reach $11 billion in 2022 with a CAGR (2017-2022) of 23.6%.

Connected cars and the dawn of V2X

We previously knew automotive connectivity as “Telematics”, which combined the terms Telecommunications and Informatics. These systems represented the central hub that exchanged data between vehicles and their environment, but connectivity now incorporates many additional applications:

- OTA (Over the Air)

- eCall

- Electronic toll

- Vehicle tracking

- Fleet management

- Navigation assistance

- Remote diagnostics

A Telematics Control Unit (TCU) combines these applications, supported by functions such as LTE, 5G, Wi-Fi, Bluetooth, e-SIM, and GPS. Semiconductor technologies are being used to enhance connectivity, including SoC, DRAM, NAND storage, RF and baseband chips, NAD (Network Access Devices), and smart antennas.

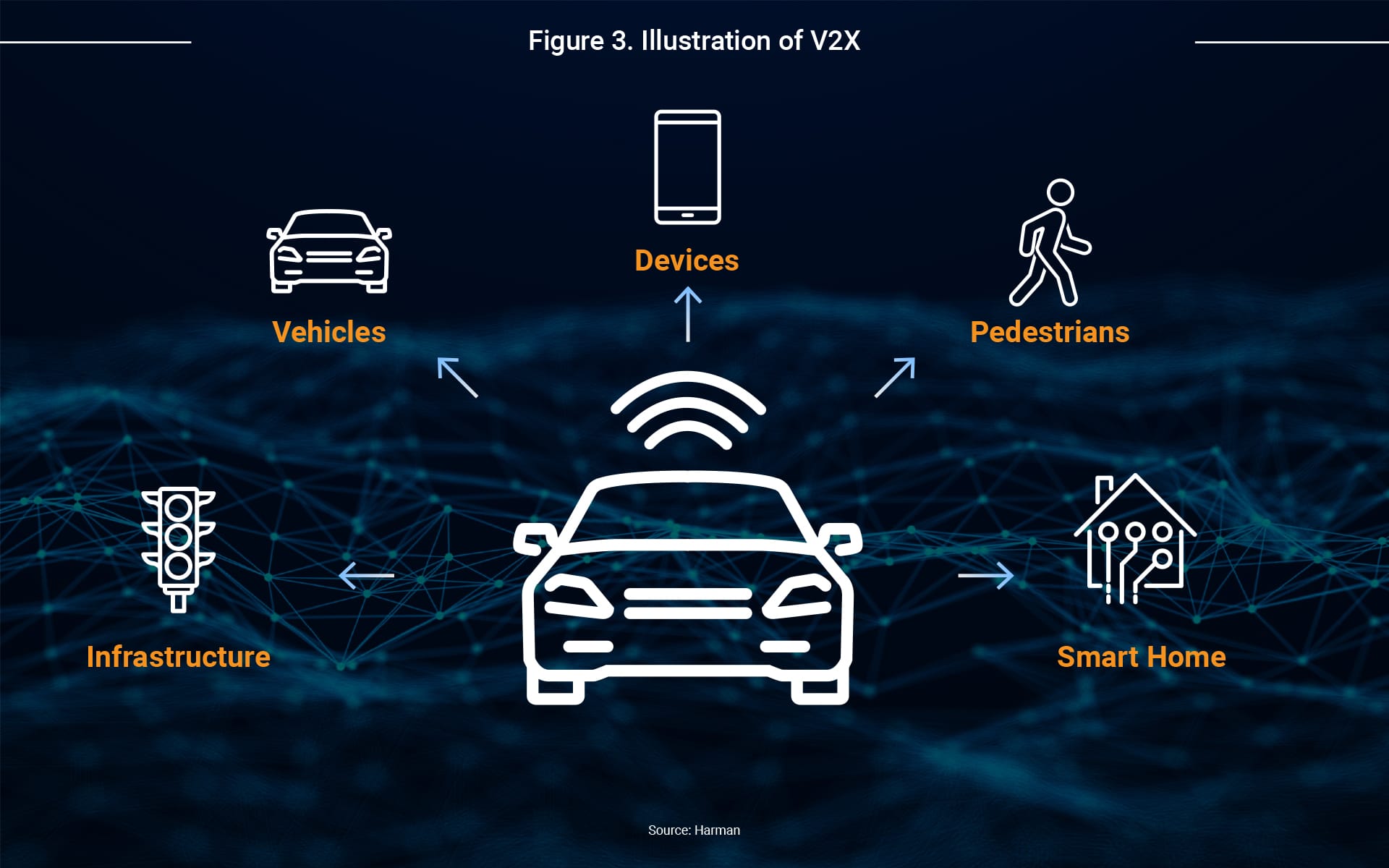

Many of today’s features are relatively simple – such as software OTA, fleet management, and eCall systems – and Deloitte estimates that over 90% of new vehicles will feature at least one base-level connectivity system by 2023. The goal of connectivity is V2X; a concept combining vehicle-to-infrastructure, vehicle-to-pedestrian, vehicle-to-vehicle, and vehicle-to-cloud – and semiconductors are playing a critical role in its development.

Electric Vehicles (EVs): Automotive industry’s next evolution

In many areas of the world, the driving force behind EVs is policy. The EU, China, the US, Japan, and South Korea are all implementing legislation to subsidize new energy vehicles (NEVs) in efforts to reduce greenhouse gases, improve air quality, and align with binding climate agreements.

These policies are having a direct impact, with TrendForce reporting that 2020s global NEV sales totaled 2.9 million with an annual growth of 43%. In 2021, it expects sales of NEVs to reach around 3.9 million out of 80 million global shipments.

This rapid electrification is having a significant impact on automotive design, especially in terms of architecture. When compared to ICEVs (Internal Combustion Engine Vehicles), EVs feature many new modules:

- Traction motor

- On-board charger

- Battery monitoring system

- DC-DC converter

- Sound-generator

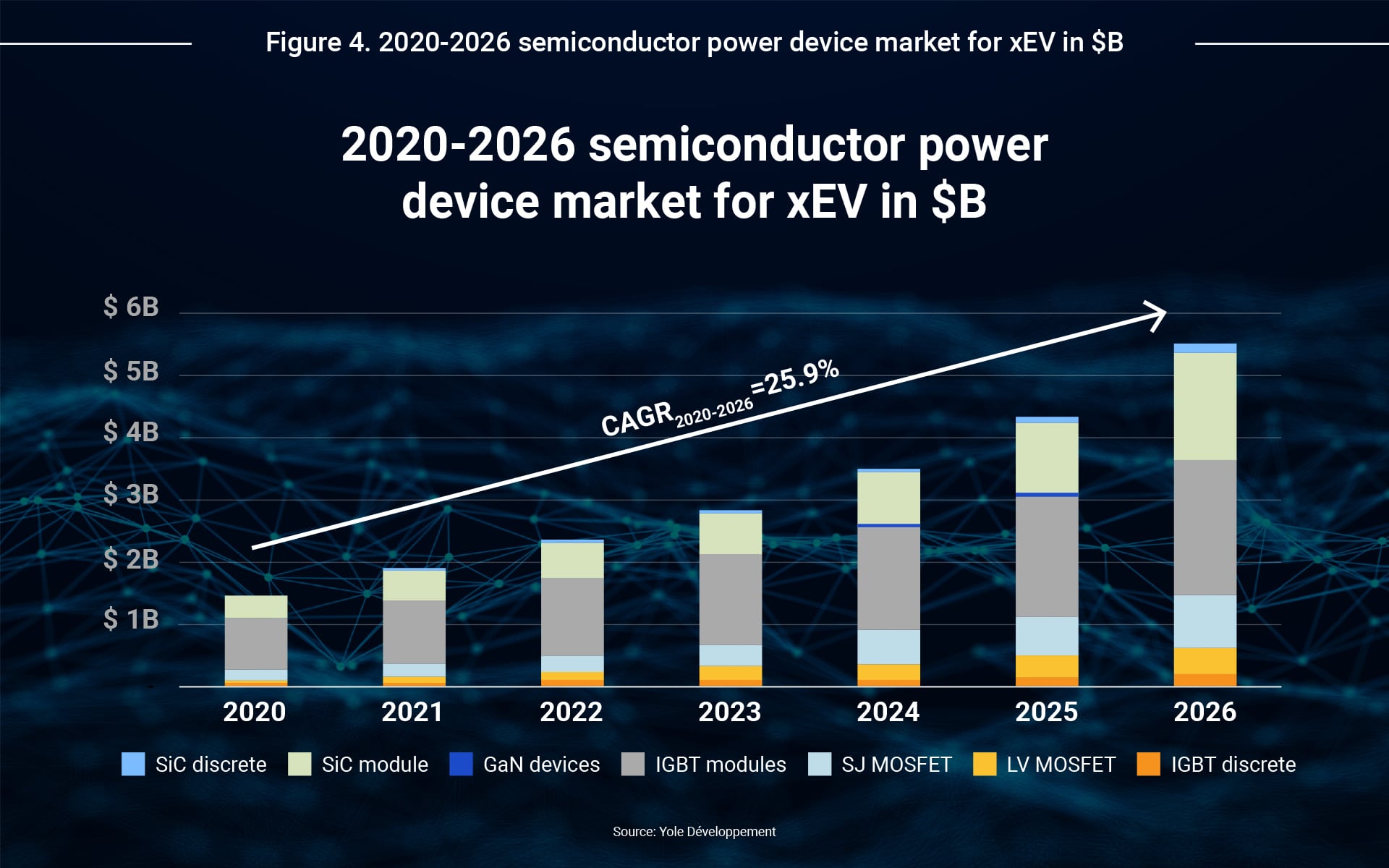

Devices such as gate driver ICs, IGBTs, MOSFETs, bipolar transistors, and rectifiers are critical for developing power controls, switching, regulating, and protection. The demand for electric powertrain systems is also driving the demand for wide-band-gap semiconductors such as SiC and GaN, which have higher switching frequencies and superior thermal performance. Yole Développement projects that the market value for EV semiconductors that power electronic devices to reach US$5.6 billion in 2026 with a CAGR (2020-2026) of 25.7%.

Shared mobility

Shared mobility is a subgroup of the sharing economy, acting as a mechanism that shares resources among users to create a hybrid mobility type between private and public transportation. Common shared mobility solutions include:

- Automobile-based

- Car rides on demand

- Carsharing and ridesharing

- Microtransit

- Micromobility

- Bikesharing

- Scootersharing

- Carpooling

Shared mobility addresses challenges such as vehicle ownership costs, traffic congestion, parking difficulties, and environmental concerns, and is driving new innovations in social networking, smartphone apps, location-based services, and internet technologies.

Semiconductor Industry: The automotive game-changers

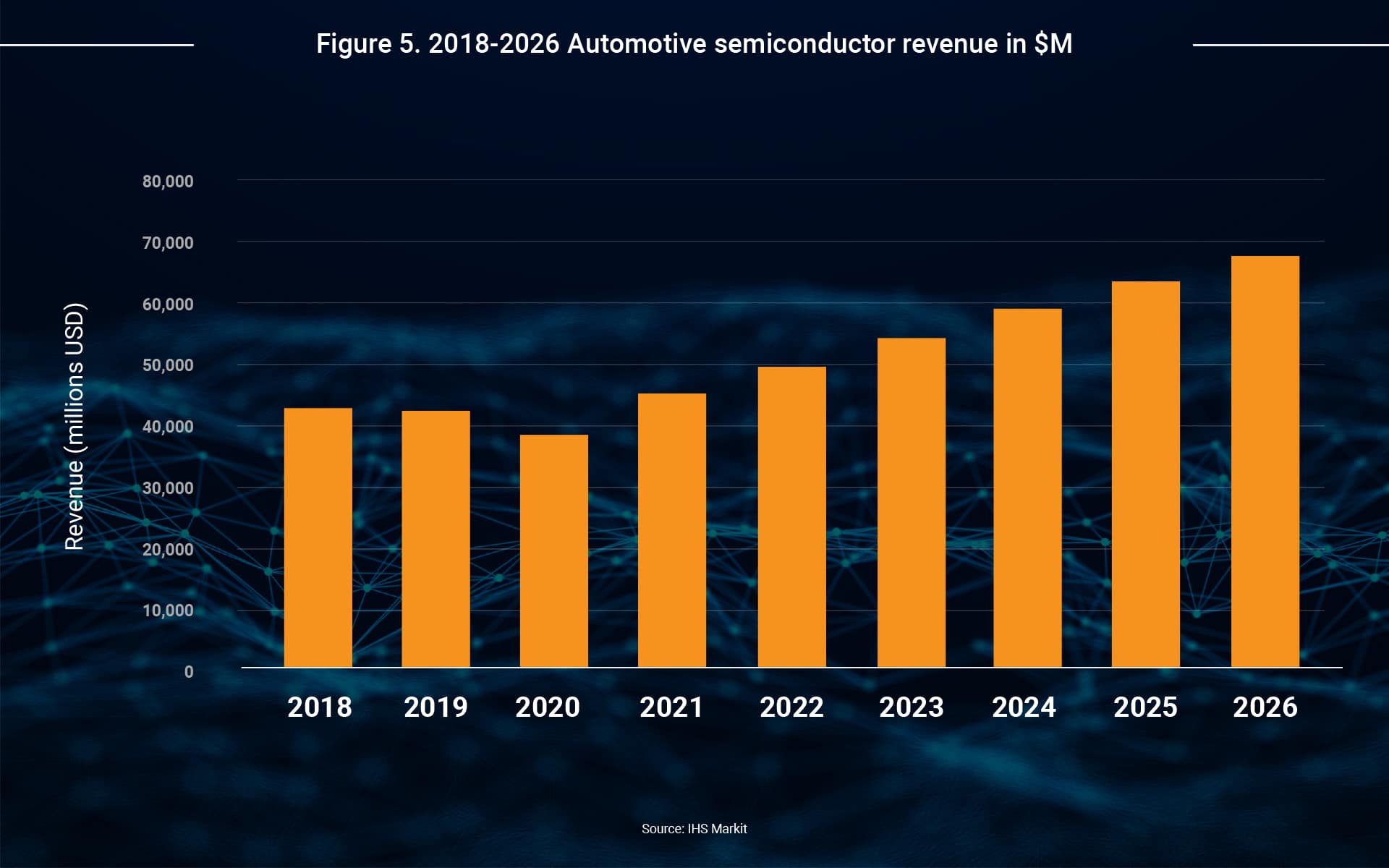

Chip suppliers are profiting from this boom in demand for automotive technologies. IHS Markit projects global automotive semiconductor revenue will grow from $38 billion in 2020 to $67.6 billion in 2026.

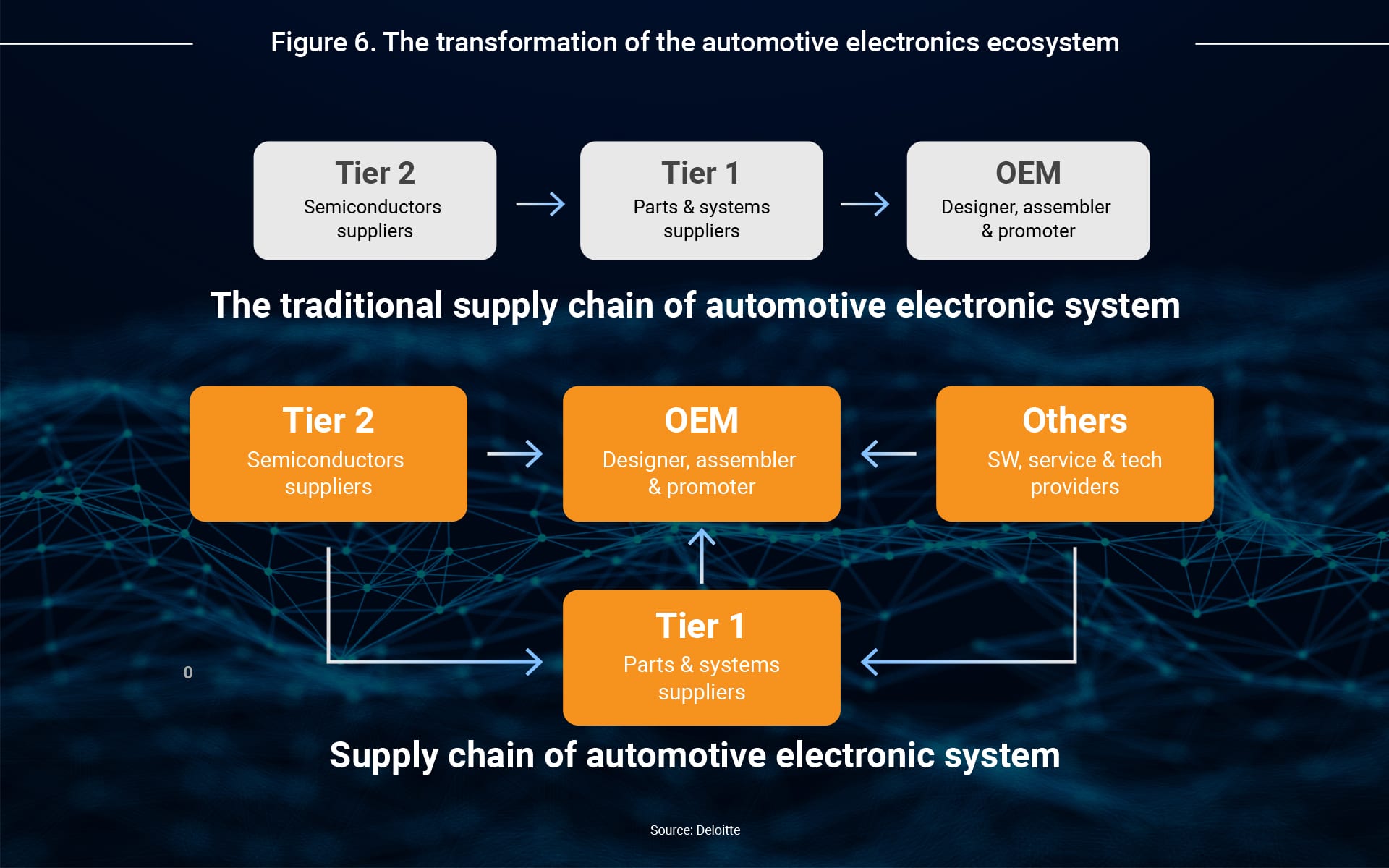

Traditionally, semiconductor suppliers sell to Tier-1, which then integrate the technologies into modules and deliver them to automakers (OEMs) for assembly. Nowadays, automotive semiconductor suppliers are cementing much more critical supply chain roles via the development of autonomous driving, digital cockpits, voice recognition, and electric powertrains. The collaboration model is also changing (Figure 6) as highlighted by these recent partnerships:

- Volvo’s collaboration with NVIDIA to use NVIDIA DRIVE Orin™ SoC technology to power the autonomous driving computer in its next-generation vehicles.

- Audi’s partnership with Samsung’s Exynos Auto V9 to design its most advanced IVI system since 2019.

- NIO’s collaboration with Qualcomm to develop next-generation digital cockpits and 5G platforms.

Of course, the real-world ecosystem is far more complicated than shown in Figure 6.

New players are rising and the roles of existing players are changing, driven by strategic partnerships, such as M&As, and JVs. As a NAND flash storage and technology services company, we believe it is a terrific idea for us to examine company’s positioning and maximize all new opportunities in this rapidly changing automotive industry.

Resources used in this article:

- Market Watch

- Daimler

- McKinsey and Company

- Deloitte

- TrendForce

- Yole Développement

- IHS Markit

- Volvo Cars

- Samsung Newsroom U.S.

- Nasdaq.com

Figures:

- Figure 1: McKinsey and Company

- Figure 2: NetApp

- Figure 3: Harman

- Figure 4: Yole Développement

- Figure 5: IHS Markit

- Figure 6: Deloitte