In this article (recently published in edited from Futurride), you’ll discover how today’s advanced on-board storage and memory solutions are helping to redefine automotive performance, quality, reliability and safety.

Automobiles today are much more than just a means of transportation. Along with other modern devices, they are leveraging human-computer interaction (HCI) to become mini-centers of communication, information and entertainment. Innovations in automotive technology – enabled by constant data collection and analytics – are driving connectivity and automation at unprecedented levels.

Data and technology are coming together to provide a whole new world of in-vehicle experiences to drivers and passengers. Apart from enabling mapping and tracking a host of vehicle and environmental parameters, automobiles are analyzing behavioral patterns of passengers to deliver advanced lifestyle choices at all times.

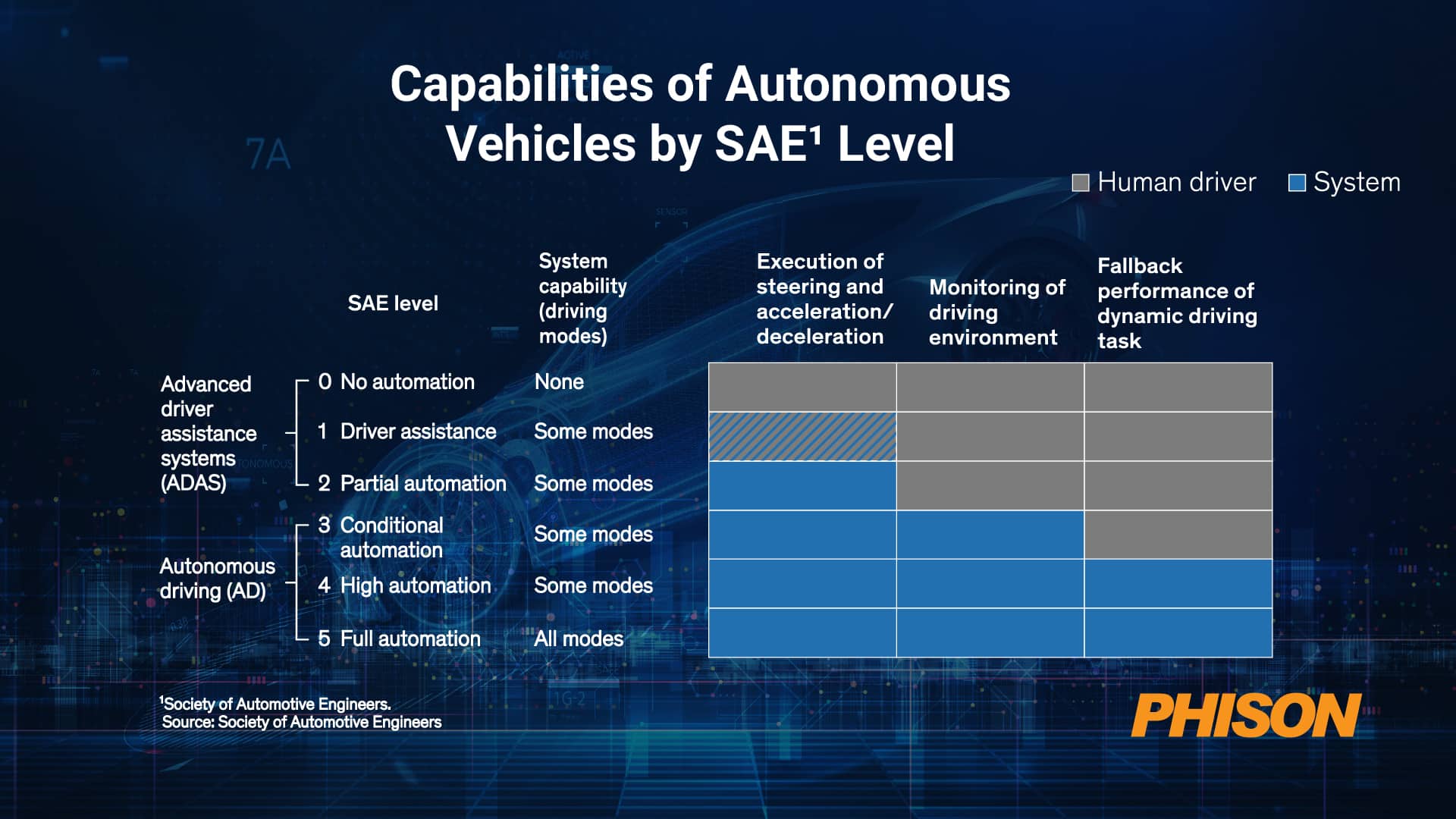

All said and done, the automotive industry is aiming to create autonomous vehicles (AVs) that can run safely with little human intervention while providing comfort and rich experiences to passengers on their journeys. Technology frameworks such as advanced driver assistance systems (ADAS) are making this possible using vehicular AI and sensor technology.

Source: McKinsey

These systems enable instant decision making In real-time data to ensure comfortability and safe driving with little-to-no human intervention. Currently, AVs with Level 3 capabilities (conditional automation) are expected to be commonly seen on the roads by 2024, while those with Level 4 capabilities (high automation) could begin pilot programs on highways as early as 2025.

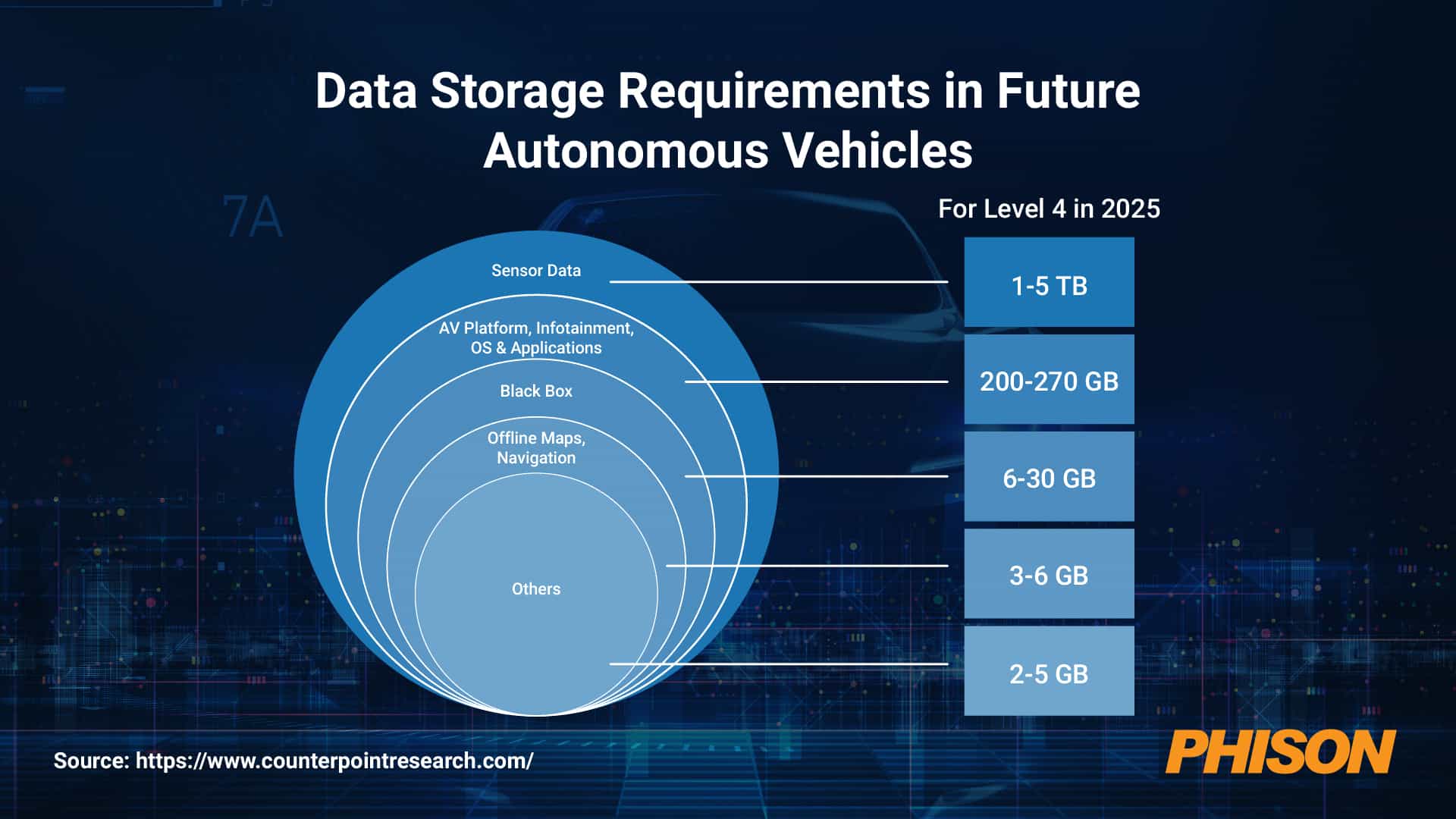

Needless to say, these automotive systems generate and process a tremendous amount of data. For example, a Google autonomous car generates about 1 GB/s. Given that the average car driver in the U.S. drives about 600 hours a year, this would mean a data storage and processing requirement of a staggering 2 petabytes (PB) per year per car!

And the automotive storage requirements don’t stop there. There is the question of connectivity. A study by Dell indicates that there will be 90 million connected AVs by 2030 that will collectively generate 1 zettabyte (ZB) every day.

Finally, there is the in-vehicle infotainment (IVI) system, which has been around for decades now. These include the audio-visual entertainment systems for passengers as well as navigation and telematics that provide 3D maps, directions, traffic conditions, etc. to the driver. Even though streaming options exist, data connections are not always reliable. To address this scenario, most streaming services offer the option of downloading local copies while at home. This trend is not likely to go away, further increasing the need for in-car storage.

The obvious lesson here is that OEMs, tier-1 automotive parts and storage/memory suppliers need to begin planning right away, if they haven’t already, to meet this demand.

The increasing demand for automotive storage

As we’ve noted, the memory and storage requirements in today’s cars are going only one way: up. While every automobile manufacturer tries to beat the competition by offering more data-driven features, we anticipate a range that increases over time:

-

-

- Telematics and V2X applications – 8 GB to 64 GB

- Infotainment – 64 GB to 512 GB

- HD mapping – 16 GB to 128 GB

- Dashboard camera – 8 GB to 128 GB

- Digital instrument cluster – 8 GB to 32 GB

- ADAS – 8 GB to 128 GB

- Accident recording – 8 GB to 256 GB

-

All in all, the daily data storage estimate for a modern car per day comes to 3 to 4 TB per day. In the near future, these requirements will only rise as AVs become the norm.

Source: Counterpoint Research

While much of this data can be eventually transmitted and stored in the cloud or even edge servers, many of the real-time and automatic actions require local processing and analysis. This requires high-capacity, high-performance, low-latency storage within the car.

The evolution of automotive storage technology

The increasing level of storage, processing and output of data in the automobile needs fast and resilient onboard memory.

When a car’s engine is switched on, the instrument clusters, control units, rear-view cameras, etc. need to boot and be ready in under one second.

NAND Flash memory is ideally suited to these applications and today’s cars have already transitioned to flash media. Unlike hard drives that have to spin up, NAND flash is solid-state memory and can come to life in less than 100 milliseconds compared to the 20-30 seconds of hard drives. Plus, unlike SRAM and DRAM that need to be supported by power to maintain the stored information, flash is inherently non-volatile.

Though NOR exists and has some benefits over NAND, it has fallen out of favor due to its low density. Today, it is often used as a replacement for eFuse or ROM boot code, while NAND flash memory is mostly used for data storage. They are sometimes combined into shared storage clusters that can handle multiple use cases, including:

-

-

- Read-intensive IVI and navigation

- Write-intensive event data recorder (EDR) systems consisting of front/rear onboard cameras

- Edge gateways and IoT sensor validation

- Vehicle tracking and fleet management systems

- ADAS and driver monitoring systems (DMS)

-

The controllers on these storage clusters can be tasked with advanced tasks such as logging, analysis and uploading/downloading of data from cloud and edge servers.

In the early days of automotive flash, storage was based on the embedded Multimedia Controller (eMMC) standard defined by the Joint Electron Device Engineering Council (JEDEC). It was simply an integrated package of NAND flash memory and its controller with 100-200 MB/s of bandwidth.

Though eMMC performance did improve, it could only do half-duplex read/write operations that allowed either read or write, but not both at the same time. JEDEC then came up with the Universal Flash Storage (UFS) standard that used a serial Low-Voltage Differential Signaling (LVDS) interface with separate read and write paths that enabled full-duplex data transfer to permit simultaneous read/write at a peak bandwidth of 2900 MB/s (UFS3.0). That bandwidth is able to outpace 400 MB/s of eMMC 5.1. There is also a growing trend to adopt NVMe Gen4 (7000 MB/s) and Gen5 (14,000 MB/s) SSD.

Key considerations and challenges in automotive storage

Less than a decade ago, automakers wouldn’t be talking directly to storage companies; at the most, they discussed chipset options with Tier 1 vendors. However, NAND flash storage now forms a significant part of the bill of materials (BOM), forcing automobile makers to engage directly with storage device and flash manufacturers and even take up data storage design in-house. This is a substantial growth opportunity for the NAND flash industry as well as the SSD industry – the automotive market will become a major customer segment as it moves toward connected and autonomous vehicles.

Cars and trucks today are expected to provide an experience that goes beyond what cell phones can do today. Customers want to see next-gen applications in infotainment, ADAS and cloud connectivity with different memory needs in terms of capacity, interface, speed, functional safety, data integrity, reliability and lifespan. This means eMMC is good for maps and GPS navigation, UFS can support IVI with high-speed read operations while PCIe NVMe is great for staying in sync with a centralized vehicle architecture and AI/ML-based applications.

Let’s evaluate the different features for automotive storage:

Performance

Automakers are increasingly turning to PCIe SSDs to meet as many storage requirements as possible. PCIe SSDs have faster sequential as well as random read/write performance compared to UFS and eMMC. Furthermore, SR-IOV, Zone Namespace and dual-port that are supported by NVMeare important elements that can enhance the efficiency of multiple virtual machines running on the centralized system in a car. They work extremely well for infotainment, as well as ADAS applications.

Quality

The auto sector has stringent quality requirements (bound by regulations in many scenarios). Automakers require an extremely low defective parts per million (DPPM) ratio, which is a tough ask for any flash, chip or controller manufacturer. IATF 16949 certification emphasizes the development of a process-oriented quality management system that provides for continual improvement, defect prevention and reduction of variation and waste in the supply chain. Storage suppliers must be compliant with it to get any automotive business.

Reliability

NAND storage is optimized for endurance across a typical range of operating temperatures from 0°C to 80°C. Automakers frequently require storage devices to operate in temperature ranges of -40° to 125°C. Specifically, they look for the AEC-Q100 certification which means the device has passed specific stress tests and guarantees a minimum level of reliability.

Safety

For automotive semiconductor companies, compliance with ISO 26262, or Functional Safety Standard, is required by major international manufacturers. Functional safety is defined as the absence of unreasonable risk due to hazards caused by failures or unintended behaviors of electrical and electronic systems. In practical terms, it means that designers must walk through every failure scenario and ensure they can be detected very quickly. All devices must provide a fallback safe state in the event that something goes wrong. The Functional Safety certification is an important point of validation and a milestone in the journey to build automotive storage solutions that lead to safer vehicles.

It’s critical for the industry to deploy products that have built-in error detection and correction mechanisms that lead to consistently better quality, and near-zero failure rates for automotive partners. Understanding the sensitivities and regulations in the automotive market reinforces quality management at the design level to ensure best results for both automakers as well as end-customers of vehicles.